Insolvency -The next Construction Tsunami?

Throughout 2022 numerous elements of the UK media have either reported or projected a surge in the number of company insolvencies across the business spectrum. Although insolvencies have always been an unfortunate aspect of business in that they reflect the inability of companies to properly manage their cash flow or otherwise make arrangements for payment with their creditors such that they can discharge their financial commitments on terms acceptable to both parties, a reported or projected surge is of obvious concern.

On the face of it, the common perception of such a surge might be attributed to the COVID pandemic during which many businesses in different parts of the world were forced to close, and to brush the potential surge off on the basis that “things are almost back to normal.”

That, unfortunately, would be an incorrect assumption as is evident from the following media extracts.

- In an article of 18th January 2022, one of London’s financial and business newspapers, CITY A.M., reported that;-

The latest monthly insolvency statistics, published this morning by The Insolvency Service for the month of December 2021, show that the number of registered company insolvencies in England and Wales is 33 per cent higher than the number registered than two years ago, just before the pandemic.

and that;-

In terms of sectors, apart from the retail, hospitality and energy businesses that have notably been impacted, Nadkarni also sees a lot of businesses in the construction sector being severely impacted by the rising fuel and material costs along with a lack of skilled workers.

“With several covid relief schemes ending in March 2022, businesses should continue to assess their cash flow positions and develop forecasts and scenario analyses to assess potential impact of these macro-trends on liquidity and solvency,” Nadkarni concluded.

- By way of a follow up article, the same newspaper, on 22nd April 2022, further reported that;-

Company insolvencies more than doubled last month as soaring inflation and rising borrowing costs pushed firms over the edge.

and

Rising borrowing costs have been compounded by soaring energy prices and moves from HMRC to recover cash from firms that failed to agree a ‘Time to Pay’ arrangement.

and

Mazars warned that the withdrawal of support meant that further insolvency surges could be expected in the coming months.

- In recognition of a worsening situation CITY A.M. went on to record in their article of 7th October 2022 that;–

Total company insolvencies in the second quarter of 2022 hit their highest quarterly level since 2009 at 5,629, as firms struggle to stay afloat amid the energy crisis.

and that;-

In England and Wales, construction, manufacturing, accommodation and food service activities, and wholesale and retail trade industries were the hardest hit, making up more than half of total business insolvencies in the first half of 2022.

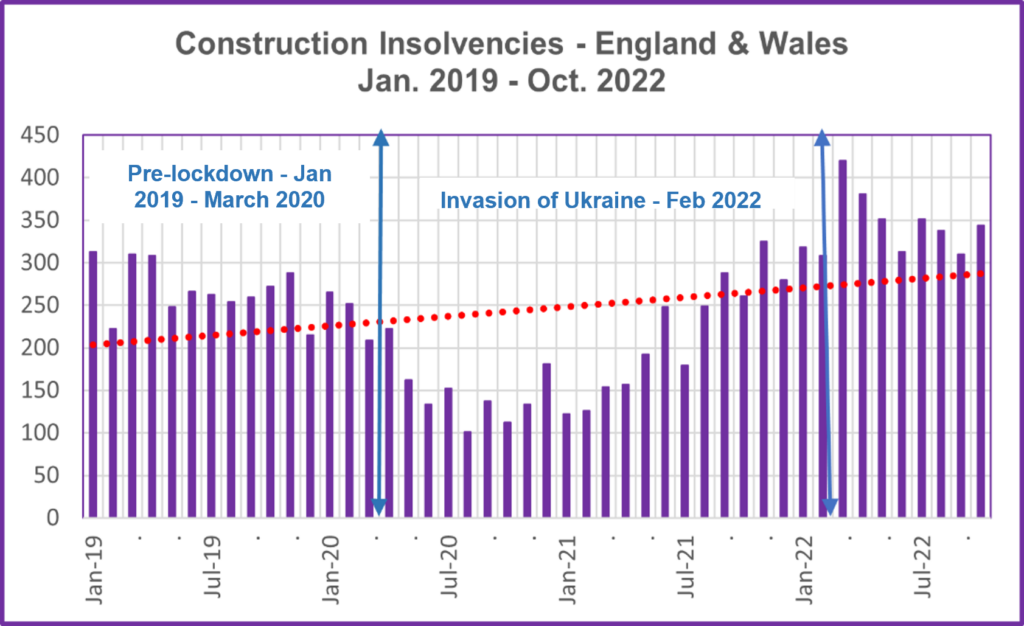

Adding credibility to the above observations are the UK Government’s Monthly Insolvency Statistics which provide a summary of insolvencies in a series of business categories. In relation to construction the statistics provide an overview of insolvencies in England & Wales from January 2019 to October 2022 as portrayed below.

Chart 1 – Construction Insolvencies, 2019 – 2022

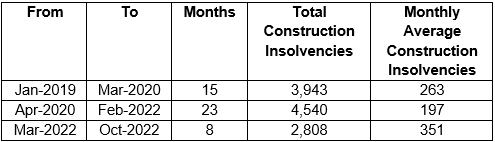

The statistics in Chart 1 can be summarised in the above three periods as follows;-

Table 1 – Average Construction Insolvencies

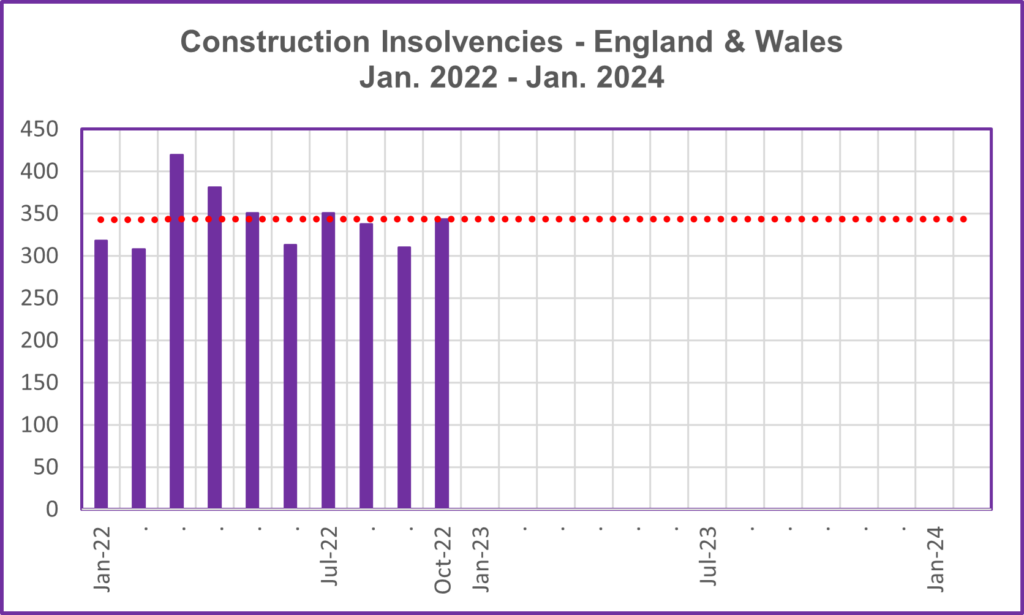

Clearly, the surges referred to above are a reality to the extent that the monthly average of construction insolvencies in England and Wales has peaked during the period to October 2022. The UK Government also provides similar sets of statistics for Northern Ireland and Scotland which seem to suggest that the upward surge in insolvencies is nationwide. By using the data applicable to England and Wales in 2022 a mathematical, linear forecast to January 2024 is provided in Chart 2 below which indicates that the current elevated level of construction insolvencies seems set to continue at approximately the current level of around 350 per month.

Chart 2 – Forecast Construction Insolvencies 2022 – 2024

With no end to the invasion of Ukraine in sight, energy prices seem set to continue at their current levels increasing costs to all U.K. construction companies which, when coupled to fierce competition and eroded or non-existent margins, would lend further support to the forecast in Chart 2. Whilst the larger participants in the construction industry may weather the storm and survive, many of those further down the supply chain may not.

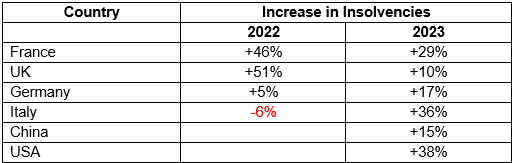

Internationally, an article in the 4th November 2022 edition of the Reinsurance News entitled “Global insolvencies expected to rise significantly in 2022 and 2023” recorded that insolvencies in numerous major economies were on the increase as tabulated below with the opening paragraph advising that;-

Global business insolvencies are expected to rise +10% in 2022 and +19% in 2023, a significant rebound after two years of decline, according to Allianz Trade.

Table 2 – Global Business Insolvencies 2022 – 2023

The numbers and percentages utilised in the above charts and tables may not be entirely consistent, but it is the case that there is consensus – there will be an upward trend in business insolvencies in 2023 and that it seems inevitable that construction companies will be in the mix.

For a construction company, or any other for that matter, a declaration of insolvency is a catastrophic event confirming that there is an inability to settle debts when they are due or at all and / or when liabilities are seen to exceed assets by any appreciable amount. In that situation, a company can enter into some form of corporate recovery programme whereby all or parts of the business continue to function, or it can cease to function and close down. It is not uncommon for a business to go through both procedures with the profitable elements of the business being sold off as working entities before the remainder goes into liquidation and the sale proceeds from the profitable elements and the value of any other assets are distributed on a proportionate basis to the entity’s creditors.

In the current circumstances where energy prices, material shortages and the general increase in the cost of living have taken a vice like grip over the construction industry and although many construction projects continue towards completion, there is inevitable uncertainty over the risk of insolvency taking on pandemic like proportions.

That said, insolvency doesn’t just happen overnight, it is a progressive ailment and there are numerous early warning signs that an Employer, Contractor, or Subcontractor could be facing financial difficulties. An obvious example is where an Employer fails to make payment within the typically generous time frames allowed in most contracts or makes payment in an amount less than the amount certified or fails to make payment at all – the Employer has a problem. It is thus of paramount importance that, where contracts permit, Contractors keep abreast of the Employer’s financial arrangements.

Signs that all is not well with a Contractor or Subcontractor arise, primarily because of cash flow difficulties induced because there is no cash in / cash out forecasting and thus no early warning of potential difficulties. These cash flow difficulties are reflected in late payments, bad debts and an inability to make payments when due and are common causes of insolvency, situations which can and do develop due to the exaggerated time frames allowed for certification and payment under construction contracts. Our article entitled Turnover is Vanity, Profit is Sanity, but Cash is King for Your Business promoted the view that Contractors go out of business not because they run out of work but because they run out of money and thus the shortening of these time frames could greatly assist struggling contractors.

Perhaps the first sign of a Contractor trying to overcome such difficulties is the submission of inflated payment applications including claims for additional payments for items not properly notified or particularised while also chasing early payment of already certified amounts. Another aspect of poor cash flow management leading to insolvency is a lack of profitability due to contracts being won in competition with little or no profit margin to the extent that the occurrence of any unexpected event can negate that margin and head a Contractor in the direction of insolvency. In addition to inflated payment applications, Contractors may request on account payments where the contract does not allow for these in order to help relieve their cash flow difficulties.

Retention is another issue that has a direct influence over a Contractor’s liquidity and thus its ability to discharge its financial obligations. It is not uncommon for Contractors experiencing financial difficulties to request the early release of retention or to request that the cash retention be released in full and be replaced with a retention bond.

In addition, there are other early indications of problems, such as;

- The work on site does not progress as planned due to a general shortage of labour such that productivity levels drop, and the likelihood of delayed completion increases.

- There is a high turnover of labour and site staff.

- There is a shortage of plant and / or hired plant is demobilised or removed by its owner in advance of completion of the task in hand.

- Material deliveries are late and / or in small quantities.

- Payments to suppliers and subcontractors are delayed.

- Subcontracted work is under resourced and performed intermittently.

- Other work on site does not proceed as planned without any explanation.

- Labour and / or subcontractors leave the site for no apparent reason.

- Creditors take some form of legal action in relation to unpaid amounts.

- Morale on site and / or throughout the enterprise is at a low level.

In our recently published article entitled You’re Terminated – Get Out of my Site!! we offered the view that terminations due to insolvency can be complex when compared with terminations due to default. That view was advanced on the basis that the provisions of a contract apply to one Employer, one Contractor, one Engineer and one project but an insolvent company may be involved with multiple parties on multiple projects with continuance of activities being permitted in some cases and termination being the order of the day in others. In these circumstances it is not uncommon that an insolvency practitioner be appointed whose function, over a spectrum of projects would, broadly, include;

- Taking control of the insolvent party’s interests.

- Notifying all creditors of their appointment and acting in their best financial interests.

- Providing creditors with settlement proposals.

- Securing the best prices when disposing of assets.

- Concluding the insolvency process as quickly as possible.

The insolvency practitioner is normally from a financial, accountancy background and as such will often require the assistance of other professionals whose expertise lies within the construction industry although the participation of the Employer or Contractor via their commercial personnel is also recommended. Principle amongst these other professionals would be a Quantum Expert who might be appointed by the insolvency practitioner or by an Employer or Contractor and could be charged with the responsibility of ensuring that;

- All the projects and all the parties are identified and notified of the situation as appropriate and assisting the insolvency practitioner to do so.

- Identifying from an inspection of the insolvent party’s accounts any areas or activities that have resulted in exceptional losses and investigating the causes.

- Examining the internal commercial reporting of the insolvent party and comparing these with similar reports of the other party to the Contract and the Engineer’s reports to the Employer with particular regard to any of the above exceptional losses.

- Advising on the ongoing applicability of the contract insurances and ensuring that these are maintained in place throughout any transition period.

- Maintaining a register of transactions and commercially relevant events.

- Preparing valuations at the point of termination in accordance with the provisions of the contract.

- Recommending the termination or assignment of subcontracts and advising an Employer if any claims against collateral warranties might be admissible / advisable.

- Advising on how any unresolved issues might best be disposed of and considering the dispute resolution mechanism inherent in the contracts – initiating these procedures in advance of an insolvency declaration will protect a party’s entitlement and avoid them being categorised amongst the other creditors.

- Advising as to whether a call on any Performance Bond or Parent Company Guarantee would be advisable and ensuring that these remain valid during any transition period.

- Assessing the cost of rectifying any defective work.

- Preparation of a final account for each project including a statement of the amounts due and owing suitable for use by the insolvency practitioner.

- Preparing an estimate of the amount required in completion of the project.

- Preparing all documentation to support the appointment of a replacement Contractor.

It may be obvious from the above that there are actions available to both Employers and Contractors which could offset the risk of insolvency if preventative measures were implemented at the outset of a project and monitoring their effectiveness as work progresses.

The first of these measures would be to make sure that the proposed form of contract identifies the risk of insolvency by either party and provides for continuance or termination by precisely setting out the appropriate procedures and making provision for payments.

A Parent Company Guarantee provided under the contract may provide some protection against insolvency but will be of little use if it is the parent company that becomes insolvent. There is seemingly little that a Contractor can do other than request that a Payment Guarantee be provided on an on-demand basis by a bank of the Contractor’s choosing. This could be an almost back-to-back arrangement with the Contractor being required to provide a Performance Guarantee on the same terms.

The contract should also make provision for collateral warranties being provided by subcontractors in order to protect the Employer in the event of defective work being discovered post termination / insolvency.

Subcontracts should reflect the terms of the main contract and should, if legally permissible, contain back-to-back payment clauses.

At the time of tender, an examination of any published financial records of the intended other party might provide an insight into their financial capabilities and should be obtained such that the risk of their insolvency can be assessed. If there is no published financial data, then a credit check might suffice and obtaining references might also be an option.

At the outset of each project, Employers and Contractors should prepare and maintain a cash flow forecast. From an Employer’s perspective, this is one directional as typically an Employer does not derive any income until completion of a project. The purpose of maintaining a cash flow forecast, cost planning, is to ensure that outgoings are not exceeding the level of available funding and to project any perceived need to revise the funding requirements. A Contractor, on the other hand incurs cost in advance of payment and needs to also ensure that it has sufficient funding available to continue operations in accordance with its contract. A regularly updated cash flow forecast can be a very efficient tool in the early detection of potential difficulties whereby a company’s management can take the steps necessary to minimise the risk of insolvency. These steps might involve, for instance, reaching agreements with suppliers and subcontractors to allow for payment of fixed amounts being spread over a period of time.

When insolvency is declared, discussion with any appointed insolvency practitioner should commence without delay such as to establish a mutually agreeable plan which might be implemented to allow projects to continue towards completion wherever possible, establishing to and from payment obligations and working towards restoring the business to a secure financial footing. Sadly, not always possible.