Turnover is Vanity, Profit is Sanity, but Cash is King for your Business

Businesses can often pursue turnover on the basis that the more business they do, then the “better” the business performance will be, or at least appear to be. However, to decide whether the increase in turnover is worthwhile, an entity needs to consider how this increase is achieved. Does the sales price need to be reduced or will it be necessary to increase costs? If either, consider the impact on net profit and whether there has been a net benefit to the business.

Therefore, rather than focussing on turnover attention should focus on profitability as the tool with which to measure business performance albeit that demonstrating profitability without considering liquidity may lead to misleading conclusions.

Profitability and liquidity can be demonstrated by considering the cash flow of a business, the comparison of money out against money in and any resultant shortfalls or excesses.

Preparing a cash flow forecast is an effort to predict the financial health of a contracting party. If the cash flowing out exceeds the cash flowing in by any appreciable amount over a sustained period, then the likelihood of financial problems arising with unpleasant consequences could increase.

From a construction industry perspective, the basic concept of cash flow is that, on the one hand, an Employer might want to pay as little as possible as late in the construction process as possible while, on the other hand, a Contractor wants to be paid as much as possible as quickly as possible.

An Employer will often make its own cash flow projection before a contract is awarded and may consider different contractual options and different payment mechanisms. These could include monthly statements from the Contractor for certification by the Engineer based on:-

- provisional quantities applied to rates contained in the contract. This method provides a high level of accuracy of the value of work done but a low level of cash flow predictability as various factors can and do influence the value of work performed month to month.

- pre-agreed amounts being paid when payment milestones are achieved. This method provides a low level of certainty of when payments may become due but a high level of predictability as to how much will be payable.

- stage payments being made in predetermined amounts, at predetermined times thus not necessarily reflecting actual progress but providing some certainty of payments to be made.

- payment against programmed activities meaning that payments are linked to completion of these activities at predetermined intervals. This method provides a reasonable reflection of the value of work done and a reasonable prediction of likely payments.

Whatever valuation method is selected the payment process can be protracted. Using the 2017 FIDIC Red Book payment terms as an example, payment may not fall due until some 56 days after receipt by the Engineer of the Contractor’s Statement and by which time the value of work performed will have increased by a further 2 months productivity and the Contractor will have incurred the associated costs. Typically, the valuation prepared for submission may be assessed by as much as 15 days before the month end meaning that the Contractor throughout the construction period is funding activities for around 71 days.

Why the Engineer and Employer are allowed such generous periods in which to perform certification and payment is not easily understood. The Engineer must maintain intimate knowledge of a project and surely does not need 28 days to check the Contractor’s Statement. Once certification is made and the Employer knows how much to pay there should be no impediment to that process given that the payments are of an interim nature and that the Employer may hold cashable bonds and securities. i.e., the risk to the Employer is minimal whilst the Contractor carries the burden of funding and the associated costs.

The Contractor’s Cash Flow Considerations

From a Contractor’s perspective, cash flow projections are essential tools in the financial and commercial management of a construction company. They provide an early warning system by projecting that point in time when there may no longer be any available source of funds thus allowing management to act. Important as profitability is, the strength of a company’s cash position is equally so as it: –

- instils confidence in creditors and lenders.

- allows the company to make payments at the time they are due.

- allows the company to make capital purchases.

- allows the company to secure better prices from suppliers and subcontractors.

- provides a contingency fund.

A Contractor’s cash flow forecast can be the sum of those prepared for individual projects together with its overheads. Cash flows prepared by Contractors for individual projects consider cash coming in against cash going out to creditors together with internal costs and contributions towards the company’s overheads. Due to the lengthy periods prevailing in most construction contracts between the time when costs are incurred and the time when payment is received, it is not uncommon for projects and companies to suffer from an insufficiency of funds with the result that bank borrowing is almost unavoidable. If the level of borrowing needed to sustain activities is insufficient to allow the Contractor to honour its commitments, administration, bankruptcy or insolvency may be the unfortunate outcome, even if the company is projecting profitability.

For Contractors, maintaining a positive cash flow is, at best, challenging. With high levels of capital expenditure and fierce competition in the procurement of new projects, Contractors take on financial risks that many other industries would find unacceptable – low, sometimes negative margins and the occurrence of unforeseen events with unrecoverable costs that prevail on any construction project. These factors combine and interact to render construction companies vulnerable to financial crises with companies going out of business not because they run out of work but because they run out of money.

There are multiple factors that contribute towards cash flow difficulties including but not limited to:-

- the estimate failing to adequately price the allocation of risk.

- failing to allow any contingency within an estimate.

- failing to develop a cost v income procurement profile.

- late certification

- retention

- protracted payment periods

- late payments

- inaccurate cost and value reporting

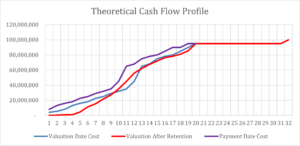

In preparation of a cash flow analysis, a Contractor might consider if it should show cost and income values at the valuation, certification or payment date as the profiles are likely to be quite different. The chart below is based on the FIDIC payment terms referred to above but without consideration of any advance payment and is based on a contract value of US$100,000,000 performed over a 20-month period with a profit margin of 5%, retention of 10% and a defects liability period of 12 months.

The chart shows that: –

- the costs accruing in the period between the valuation and payment dates would exceed the income throughout the construction period requiring Contractor funding.

- at the end of that period, costs and income would be the same after release of half of the retention.

- the balance of the retention would then be released 12 months later at which point the contractor would realise its profit in cash terms.

- no costs in the defect’s liability period are included and any such costs would serve to reduce the profit

A Contractor’s estimate provides the platform from which a preliminary cash flow forecast can be prepared, and that forecast should take account of: –

- the preliminary programme

- any advance payment

- periods of reduced activities

- reduced productivity due to weather

- the effect of retention and its phased release

- the uncertain costs associated with a defects liability period.

The preliminary forecast should be used to assist in structuring the tender in such a way as to ensure recovery of costs and profit at the earliest opportunity to avoid a situation as depicted above. With modern software applications it is straightforward to create different scenarios with that aim in mind.

However, these scenarios and the overall preliminary forecast should be based on when the costs are likely to be incurred and when income for performance of an activity might be expected rather than just spreading the estimated allowance for that activity over the estimated duration for it.

As the preliminary cash flow projection is progressively updated, the updates ought to reflect the impact of: –

- any incorrect assumptions in the preliminary cash flow projection

- variations and claims

- delays and extensions of time

- acceleration

- escalation

- finance charges

Conclusion

- liquidity is basic to survival.

- profitability and liquidity determine the financial health of a business.

- although imprecise, cash flow forecasting is an essential tool in monitoring profitability and liquidity.

- Contractors are confronted with onerous payment terms that necessitate borrowing.

- Contractor’s may not realise their profits in terms of cash for extended periods.

- At the end of the day – Turnover is Vanity, Profit is Sanity, but Cash is King for Your Business.